south dakota motor vehicle sales tax rate

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Dyed fuels subject to sales tax are.

What S The Car Sales Tax In Each State Find The Best Car Price

Initiated in 1986 to help subsidize bridge and highway maintenance you pay the South Dakota wheel tax when you are registering your vehicle with the South Dakota Department of Revenue DOR.

. All motor vehicles including ATVUTV and motorcycles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax on the total purchase price. The average sales tax rate on vehicles across the state is. One exception is that the sale or purchase of a motor vehicle subject to the.

Only some SD counties. The vehicle identification number VIN. Motor vehicles not subject to motor vehicle excise tax include.

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. However the buyer will have to pay taxes on the car as if its total cost is 12000.

With local taxes the total sales tax rate is between 4500 and 7500. With local taxes the total sales tax rate is between 4500 and 7500. With local taxes the total sales tax rate.

In addition for a car purchased in South Dakota there are other applicable fees including registration title. Repealed by SL 1990 ch 230 7. As the name implies you pay a certain amount for each tire depending on your vehicles weight class and county.

Motor Fuel Excise Taxes. South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price. Mobile Manufactured homes are subject to the 4 initial registration fee.

The state sales and use tax rate is 45. Different areas have varying additional sales taxes as well. South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles.

Municipal governments in South Dakota are also allowed to collect a local-option sales tax that. South Dakota Codified Laws 32-5B-21 32-5B-21. For additional information on sales tax please refer to our Sales Tax Guide PDF.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. 31 rows The state sales tax rate in South Dakota is 4500. 2 per wheel 24 maximum per vehicle.

Select the South Dakota city from the. Purchasers in south dakota are charged a 4 excise tax which is much lower than most states and south dakota has low registration fees as well. South Dakota has a higher state sales tax.

This includes South Dakotas state sales tax rate of 4000 and Rapid Citys sales tax rate of 2500. Do you pay sales tax in South Dakota. This is the case even when the buyers out-of-pocket cost for the purchase is 10800.

South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. Applicable municipal sales tax motor vehicle gross receipts tax and tourism tax on any vehicle product or service they sell that is subject to sales tax in South Dakota. The South Dakota liquor tax applies to all hard alcohol alchoholic beverages other then.

South Dakotas excise tax on Spirits is ranked 31 out of the 50 states. What is the sales tax on a vehicle in South Dakota. All fees are assessed from purchase date regardless of when an applicant applies for title and registration.

Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that applies to the rental of cars trucks motorcycles and vans if the business rents them to the same person for less than 28 days. 2 April 2015 South Dakota Department of Revenue Motor Vehicle Sales Lease and Rentals and Repairs Tax Facts Motor Vehicle Sales and Purchases With few exceptions the sale of products and services in South Dakota is subject to sales or use tax. An additional 2 wholesale tax applies to the sale of wine or spirits in South Dakota.

Registrations are required within 45 days of the purchase. Certain trailers are also. Depending on what the dyed fuel is being used for will determine the tax rate that is paid.

The South Dakota excise tax on liquor is 463 per gallon lower then 62 of the other 50 states. 228 Dyed Diesel Fuel. South Dakota has recent rate changes Thu Jul 01 2021.

South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. South dakota motor vehicle sales tax rate. The South Dakota sales tax and use tax rates are 45.

Sales Tax Rate Charts. The South Dakota sales tax and use tax rates are 45. Does South Dakota have sales tax on vehicles.

All brand-new vehicles are charged a 4 excise tax in the state of South. 171 Dyed Biodiesel Blends. South Dakotas 8000-mile networks of highways and airport runways are essential to the states economy and its citizens quality of life Fuel taxes are used to fund the maintenance and construction of South Dakotas highways bridges and airport runways which are a vital part of the states infrastructure.

What is South Dakotas Wheel Tax. If any motor vehicle has been subjected previously to a sales tax use tax motor vehicle excise tax or similar tax by this or any other state or its political subdivision no tax is owed. Motorcycles cars pickups and vans that will be rented for 28 days or less Trailers with a trailer.

The south dakota state sales tax rate is 4 and the average sd sales tax after local surtaxes is 583. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. When you come to South Dakota and will not have to pay any additional tax if your states tax rate is above South Dakotas.

Imposition of tax--Rate--Failure to pay as misdemeanor. A written form must be submitted to the South Dakota Motor Vehicles Division before motor vehicle records can be. South Dakota Taxes and Rates Motor Vehicle.

All car sales in South Dakota are subject to the 4 statewide sales tax. State Sales Tax plus applicable municipal sales tax applies to the selling price of dyed fuel when it is. Additionally if you want to avoid surprise.

The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45.

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Free South Dakota Motor Vehicle Bill Of Sale Form Pdf 33kb 1 Page S

New Municipal Tax Changes Effective July 1 2021 South Dakota Department Of Revenue

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Use Tax Laws Regulations South Dakota Department Of Revenue

What S The Car Sales Tax In Each State Find The Best Car Price

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Sales Use Tax Laws Regulations South Dakota Department Of Revenue

New York Sales Tax Guide For Businesses

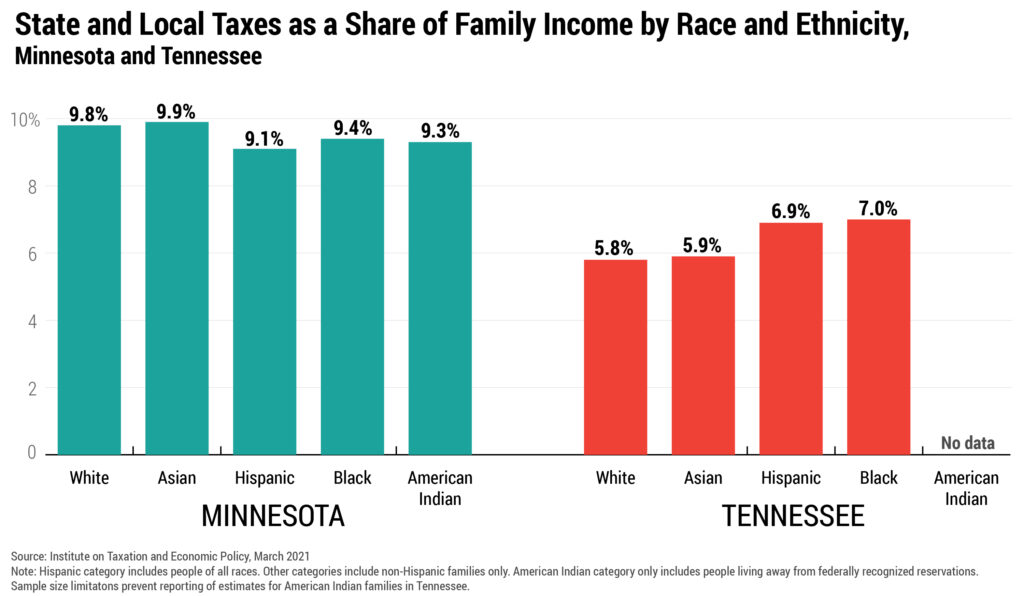

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep

What S The Car Sales Tax In Each State Find The Best Car Price

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

What S The Car Sales Tax In Each State Find The Best Car Price